This tax credit is based on your adjusted net family income and is reduced when your salary or wages exceeds certain amounts. Using this tax credit is how to claim rent on taxes in Ontario. If you live in Ontario, you may be eligible for the Ontario Energy and Property Tax Credit (OEPTC), which is part of the Ontario Trillium Benefit (OTB). However, it is always recommended to have this documentation and rent receipts ready should you be reassessed or audited by the CRA (Canada Revenue Agency).

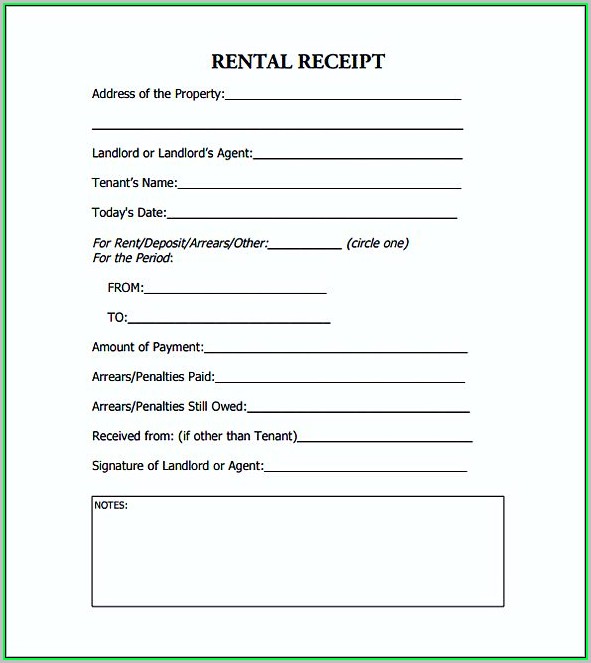

Not all tax programs require you to submit rent receipts when claiming rent on your income tax. If a tenant leased at multiple addresses in the tax year, they need this information for each location.

Otherwise, you are not able to claim rent on your tax return. Second, self-employed individuals may be able to claim rent paid on their taxes if they meet certain criteria.Īs long as you meet the eligibility for these credits, you will be able to claim rent on your tax return in Canada. There are three provinces that offer tax benefits or credits that you can claim your rent within: Ontario, Manitoba, and Quebec. How to Claim Rent On Tax ReturnĪs a Canadian looking to claim rent in their tax return, you have two options.įirst, some provinces offer benefits that take into account your rent paid. Here, the team of tax experts at Accountor CPA explores the options for claiming rent on income tax.įor detailed advice about how rent tax returns apply to your situation, contact Accountor CPA. Can you claim rent on your taxes as a deduction or credit?ĭepending on your tax situation and province of residence, you may be able to claim rent on income tax in Canada. Whether you are renting a room, an apartment, a condo, or a whole house, rent payments in Canada are significant expenses. If you pay rent for your home, it is likely the largest expense you have each month. Rent prices across Canada have skyrocketed in recent years.

0 kommentar(er)

0 kommentar(er)